To succeed in modern SEO, it’s important to focus your attention as a marketer beyond the ‘keyword’, and to consider the audiences and communities that are actively searching around a keyword topic.

From my personal experience, I’ve seen a tendency for highly skilled SEO professionals to shy away from discussions around audiences, pain points, interests and messaging to remain in their comfort zone. This comfort zone is keyword intelligence, page optimisation, backlink strategy and technical SEO.

I’ve then witnessed how SEO growth can be hindered by this myopia in the long-term. Commonly, SEO performance decreases over time as a result of stagnant content strategies and ineffective digital PR campaigns which fail to acquire authoritative, relevant backlinks.

At Semetrical, we partnered with Audiense and Pulsar to survey the SEO community, and our findings validated my hypothesis that others struggled too.

SEO Strategy Survey Findings

The SEO community’s responses were fascinating, and highlighted the need for a better understanding of the audiences and communities active within priority keyword topics.

Only 16% of SEOs incorporate social media data into their SEO strategy, yet 40% struggle to deliver consistent high quality content and 88% would like to speed up link prospecting.

At the same time, 63% believe that traditional keyword data from search engines alone doesn’t provide enough insight into the interests and behaviours of their target audiences.

This confirms that the problem I observed from my personal experience is even more widespread.

The solution?

Develop an ‘audience-first SEO’ strategy that integrates social media behavioural data from audience intelligence technology with your existing keyword intelligence.

1.1 The benefits of formulating an audience-first SEO strategy

The result? You will experience a myriad of benefits, including:

- Understand keyword-level ‘search audiences’ by gathering behavioural insights using social consumer segmentation data from audience intelligence research

- Enhanced keyword-level content strategy and SEO topical modelling informed by integrating keyword intelligence and audience intelligence insights

- Prospect hyper-relevant influencers and link opportunities at scale efficiently per niche audience community within a keyword segment.

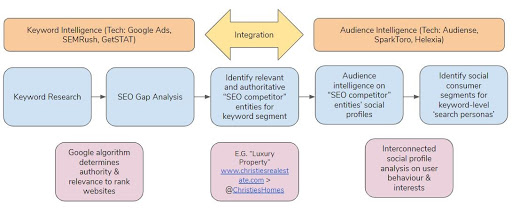

2.1 How do you integrate keyword intelligence and audience intelligence?

There are a number of technologies that are leading the way within the emerging category of audience intelligence, including Audiense, Pulsar, Helixa and SparkToro. They analyse big data from Twitter and other data sources through AI and machine learning to identify audience segments and their associated entity affinities, interests and behaviours.

We’ll look first at the theory, then we’ll use Audiense for audience intelligence research and Pulsar for social listening analysis to demonstrate step by step how you develop an ‘audience-first SEO’ strategy.

2.2 Keyword intelligence process overview

Below is a summary of what we as SEOs and digital marketers get from keyword intelligence:

- A process for identifying relevant, high value keywords

- A way to develop keyword strategies for SEO visibility across the sales funnel

- The ability to prioritize your SEO strategy to increase organic visibility based on competitor insights.

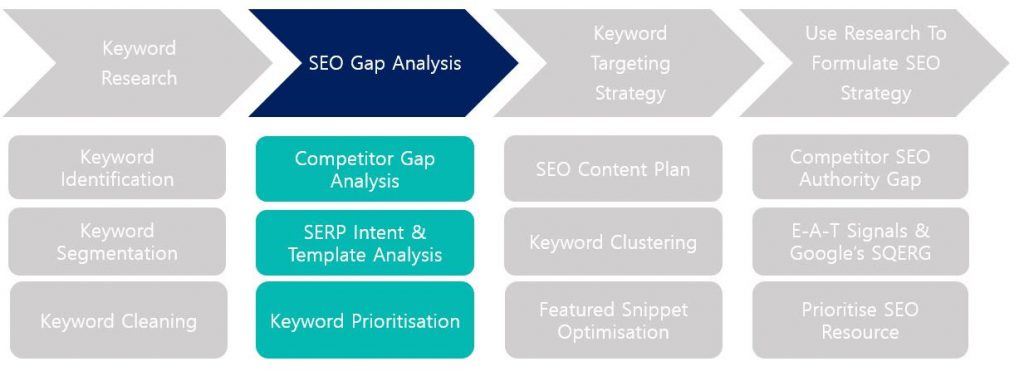

And most SEOs are familiar with the 4 stages of keyword intelligence, which include:

- Keyword research to identify all possibly relevant keywords

- SEO gap analysis to identify relevant keywords based on competitor insights (Read Semetrical’s SEO gap analysis guide which features a clear step-by-step overview of this process)

- Keyword targeting strategy based on keyword intelligence

- Ongoing content & backlink acquisition campaigns to boost SEO performance.

Image: Keyword intelligence process – all

Image: Keyword intelligence process – all

2.3 Audience intelligence process overview

The audience intelligence process then enriches your keyword data by overlaying social media behavioural and interest data from audience intelligence technology at key stages of the research process.

Audience intelligence provides:

- Analysing social consumer segments which are derived from a larger subset of the market outside that of your brand’s customer base

- Provides richer, more relevant audience insights based on behaviours and interests

- Tailor strategies to their interests and increase likelihood of achieving KPIs.

Image: Keyword intelligence and audience intelligence process – integration

Image: Keyword intelligence and audience intelligence process – integration

We’ll go into each of these stages in more detail and how you can practically manage this process step-by-step.

2.4 Integrating keyword intelligence and audience intelligence

The strength of this process comes from being able to integrate these two intelligence strategies. The diagram below shows how you would go about visualising this integration.

You must first implement keyword intelligence to identify the SEO competitors (best performing websites) for your priority keyword segments.

You would then proceed to upload the Twitter profiles of those SEO competitors into an Audience Insights report, in a platform like Audiense, to analyse the interconnections between social profiles to identify keyword level search audiences and the social consumer segments that are active within them.

Image: Keyword intelligence and audience intelligence integration diagram

Image: Keyword intelligence and audience intelligence integration diagram

As a result, you’ll establish an audience-first SEO strategy that provides a far better understanding of the behaviours, interests and influencers of the audiences and communities active around your priority keyword segments. This leads to more effective content and digital PR campaigns that enable SEO topical modelling and high velocity link acquisition from relevant websites.

3.1 An audience-first SEO process walk-through for the UK property industry

Now that we’ve seen the main principles of this process, let’s look at a step-by-step example to make these principles more concrete.

I shall take the UK property industry to demonstrate this process.

3.2 Keyword segmentation and SEO gap analysis

Upon undertaking our keyword intelligence stage 1 and 2, you would end up with your keywords segmented into dimensions (themes or topics) and segments (sub-themes or sub-topics).

Image: Keyword segmentation – UK Property Example

Image: Keyword segmentation – UK Property Example

In the example, we can determine that not all keywords follow the “[X] bed property/home/house/flat to rent/to buy in {X location}” long-tail search pattern. Instead, there are additional keyword segments including: 1) New Homes; 2) Luxury Properties; 3) Commercial Property.

Each of these keyword segments will have different SEO competitors, and be evaluated by the algorithms based on different signals (e.g. more weighting given to backlinks received from relevant websites to a niche topic).

Image: Keyword intelligence process – SEO gap analysis

Image: Keyword intelligence process – SEO gap analysis

Therefore, we’re going to need to develop tailored keyword-level SEO strategies for each additional keyword segment to drive performance. To achieve this we need to better understand the relevant audiences and their interests, behaviours and influencers.

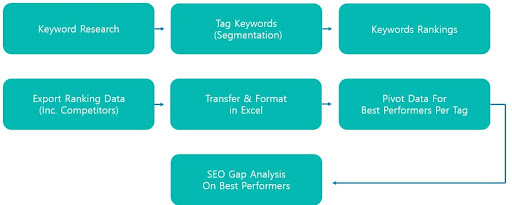

The SEO Gap Analysis stage of the keyword intelligence process identifies the SEO competitors for your priority keyword segments. To do this, upload your tagged keywords into a ranking tracking tool to identify the websites that perform best per keyword segment.

These are your SEO competitors for that keyword segment.

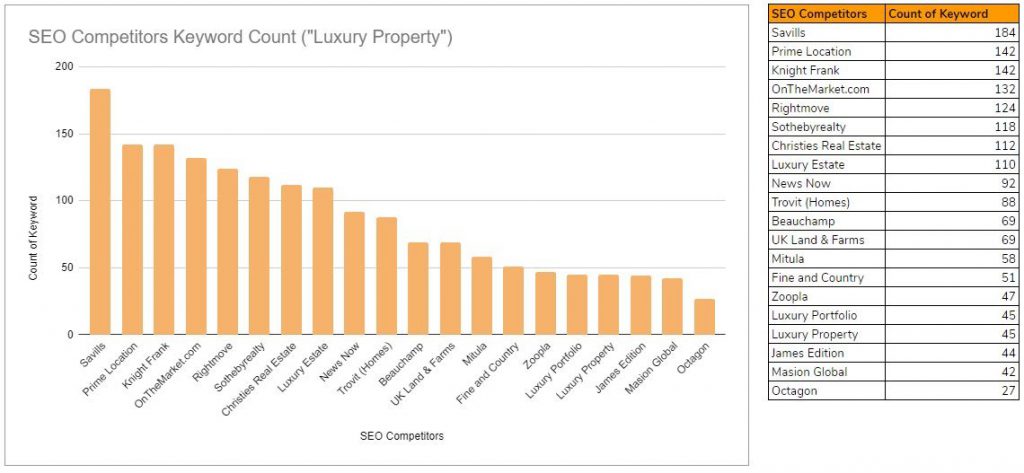

For the “Luxury property” keyword segment, the SEO competitors for a property portal brand such as OnTheMarket.com or Rightmove may include the likes of Savills, Knight Frank, Christies Real Estate and Luxury Estate; whilst the SEO competitors for “New Homes” may include Taylor Whimpey, Smart New Homes, The Construction Centre.

Image: SEO gap analysis process

Image: SEO gap analysis process

Our keyword intelligence process would identify the SEO competitors for the “Luxury Property” keyword segment based on total number of keywords and average rank.

Image: SEO competitors – Luxury Property Keyword Segment

Image: SEO competitors – Luxury Property Keyword Segment

You should have all of this data in Excel, and I recommend that you select only the most hyper relevant SEO competitors to the keyword topic to upload into your audience intelligence platform, as you can end up diluting your insights otherwise.

For example, within the “Luxury Property” SEO competitors you would exclude the following from your audience intelligence report:

- Rightmove (too broad an audience)

- Zoopla (too broad an audience)

- OnTheMarket.com (too broad an audience).

But you would include the following in your audience intelligence report:

- Savills (Luxury and high-end specific audience)

- Knight Frank (Luxury and high-end specific audience)

- Christies Real Estate (Luxury and high-end specific audience).

Image: Luxury Property SEO Competitors List Cleaning

Image: Luxury Property SEO Competitors List Cleaning

3.3 Uploading Twitter profiles of SEO competitors into audience intelligence technology

The next stage would be to upload the Twitter profiles of those SEO competitors into an audience intelligence report per keyword segment to identify the active social consumer segments.

Image: Keyword intelligence and audience intelligence process – integration – audience intelligence report

Image: Keyword intelligence and audience intelligence process – integration – audience intelligence report

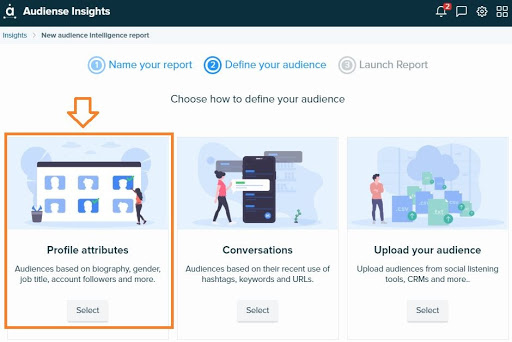

Next, if you were to use Audiense as your audience intelligence technology, you would select Audience Insights as your report, name it appropriately (e.g. “Luxury Property Search Audience”) and select the Profile Attributes option.

Image: Audiense Insights – Interconnected Profiles Upload

Image: Audiense Insights – Interconnected Profiles Upload

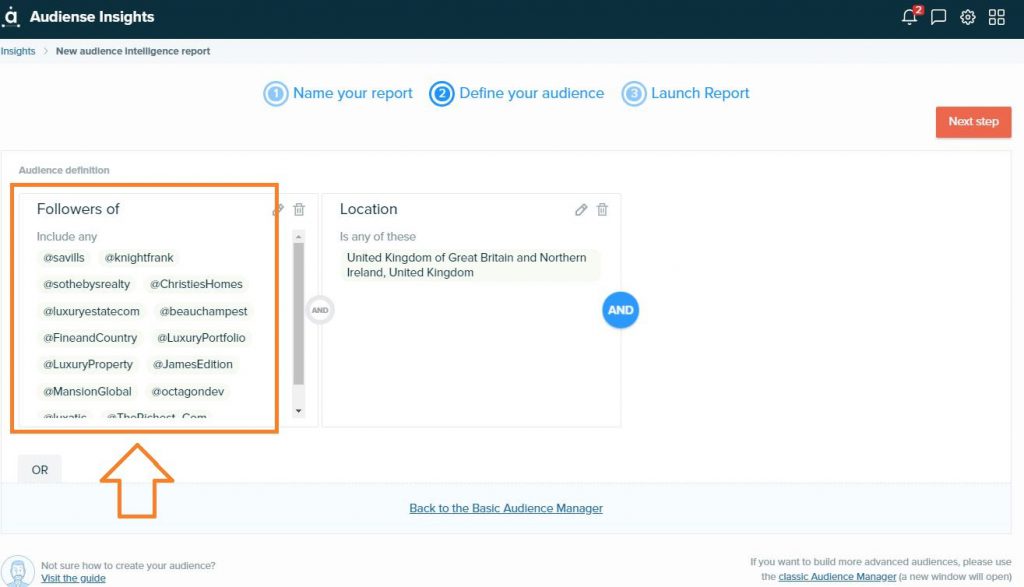

Then select ‘Followers of’ and list the Twitter profiles of the SEO competitors. You can see the example for the “Luxury Property” keyword segment.

Image: Audiense Insights – SEO Competitors Upload – Interconnected Profiles – Luxury Property

Image: Audiense Insights – SEO Competitors Upload – Interconnected Profiles – Luxury Property

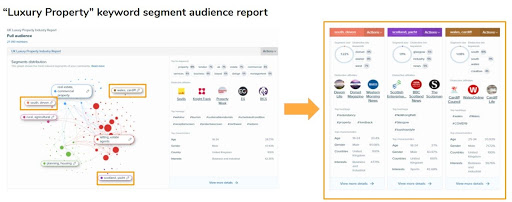

3.4 Analysing your keyword level search audience reports

Create your report, and within an hour or two, you will be able to review the audience intelligence report. If we take the “Luxury Property” keyword search audience, you can see that report has generated social consumer segments for:

- “Rural , agricultural”

- “Letting, estate agents”

- “Real estate, commercial property”

- “Planning, housing”

- “South, devon”

- “Scotland, yacht”

- “Wales, cardiff”

Now, let’s say we want to investigate and understand more about the niche luxury property seeker in the UK property market. This will help us plan audience-first backlink campaigns that appeal to their interests and ultimately more likely to get featured in relevant publications for the “Luxury property” keyword segment. Image: Luxury Property Niche Luxury Property Seekers Audience Segment

Image: Luxury Property Niche Luxury Property Seekers Audience Segment

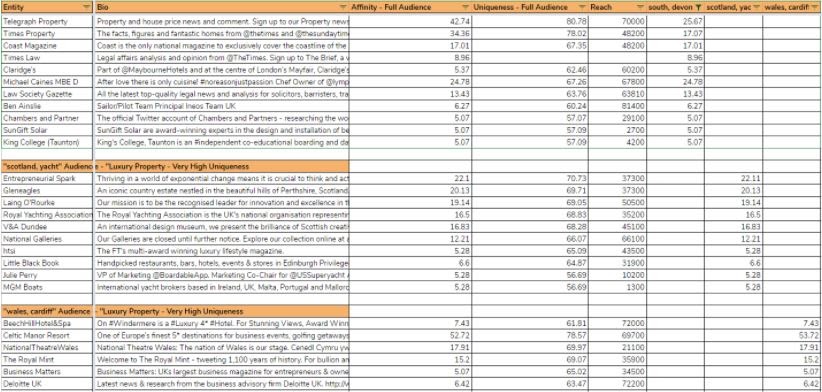

I’ve noticed a number of niche social consumer segments in the report: 1) “South devon”; 2) “Scotland, yacht”; 3) Wales, cardiff” that could contain insights into the luxury property seeker.

We would navigate to the ‘Influencers and brands’ section of the report for each social consumer segment and filter based on the highest affinity scores.

Next, we can export the data into Excel and begin to identify the entities that share a notable or high affinity score with these social consumer segments, starting to establish an understanding of the niche luxury property seeker’s interests, influencers and behaviours.

Image: Luxury Property – Audience Segments Affinity Scores – Niche Luxury Property Seekers

Image: Luxury Property – Audience Segments Affinity Scores – Niche Luxury Property Seekers

3.5 Identifying your search audience profiles from social consumer segmentation

Using the affinity scores (which are measured on engagement and follow patterns of Twitter users that share similar characteristics), we can begin to build a profile of the luxury property seeker within the “Luxury Property” keyword level search audience.

Image: Luxury Property – Audience Segments Affinity Scores – Niche Luxury Property Seekers

Image: Luxury Property – Audience Segments Affinity Scores – Niche Luxury Property Seekers

If we were to analyse the entities with high affinity scores to other social consumer segments active within the keyword segments, we can quickly identify link opportunities and it helps to stimulate content ideas.

Here is the “property, estate” social consumer segment’s affinities within the “New Homes” and “Luxury Property” keyword segment: Image: New Homes and Luxury Property – Residential Estate and Letting Agents – Search Audience

Image: New Homes and Luxury Property – Residential Estate and Letting Agents – Search Audience

Here is the “planning, housing” social consumer segment’s affinities within the “New Homes”keyword segment:

Image: New Homes – Housing Planning – Construction, Regeneration, Infrastructure + Architects – planning, housing Search Audience

As you can see, this process enables you to prospect hyper-relevant influencers and link opportunities at scale efficiently per audience and community within a keyword segment.

4.1 How do you optimise towards audience-first SEO?

To successfully optimise towards audience-first SEO, you need to consider the insights from your keyword intelligence and audience intelligence to focus on making sure your brand is relevant to the search patterns, interests, cultures and behaviours of your target audiences.

4.2 Identify the keyword segment to audience overlaps and differentiation

Use your research to build a Keyword to Audience Matrix. If you’re not familiar with this type of matrix, it will enable you to identify the keyword-segment-to-audience overlaps and differentiations for your target keywords. It can be a really powerful way of communicating to other departments in your organisation or to your client regarding which audiences you will reach by improving SEO performance for certain keywords.

Image: Keyword Segment to Audience Overlap and Differentiation

Image: Keyword Segment to Audience Overlap and Differentiation

4.3 Develop SEO topical modelling strategies

Now that you know which keyword segments align with each audience, you are in a better position to use the right SEO strategies to develop the keyword segments for relevant audiences.

This methodology works because SEO strategies succeed when they are meticulously focused on improving a website’s relevance and authority to a priority keyword segment.

It can be implemented through the advanced SEO concept of SEO topical modelling, whereby transactional keywords are targeted by SEO pillar pages which are supported by relevant sub-topic pages. These pages are internally linked back to the SEO pillar page and should share the same overall semantic theme. This helps rank the SEO pillar page as search engines favour this approach, as shown by numerous studies.

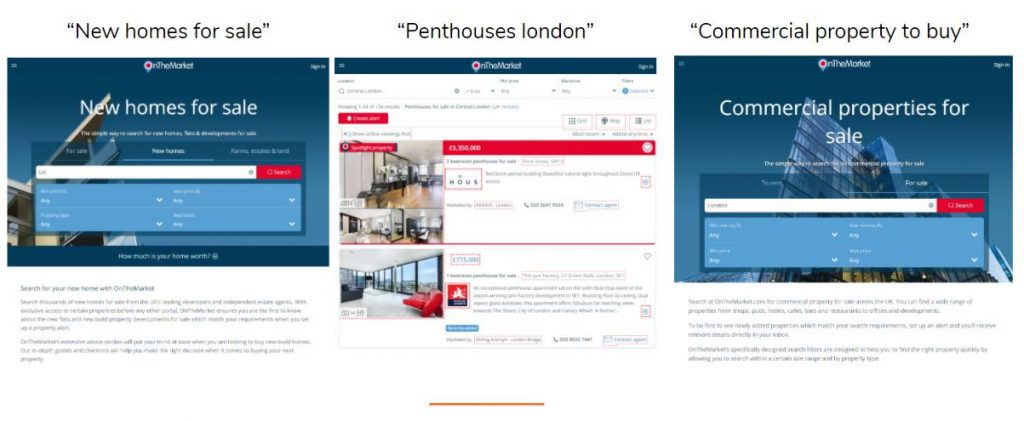

Image: SEO Pillar Pages Property Portal

Image: SEO Pillar Pages Property Portal

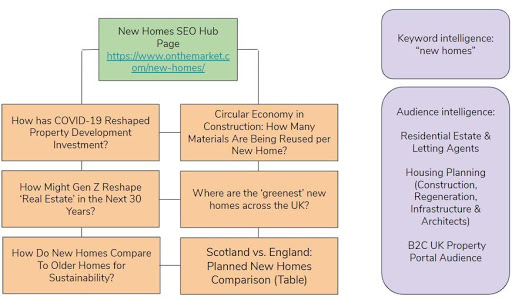

If we take a UK property portal, OnTheMarket.com as an example, we would see that the SEO pillar pages for the three keyword segments: 1) New Homes; 2) Luxury Property; 3) Commercial Property, need to be bolstered by ongoing publishing of fresh content. This content needs to be relevant not only to the keyword topic but also to the audience’s changing interests and behaviours.

In the example website architecture diagram for “New Homes”, you can see how you could align your keyword targeting strategy with the relevant audience segment interests to develop your SEO topic clusters.

These articles don’t rely on only evergreen informational keywords, which quickly becomes copy-cat content. Instead, they overlay real-time audience insights to stay hyper relevant to the conversations around “New Homes” in the UK property market. All whilst supporting the SEO pillar page that ranks for the evergreen head search term “New Homes” and others.

Image: SEO Topical Modelling Diagram

Image: SEO Topical Modelling Diagram

4.4 Generate a continuous stream of content and digital PR campaign ideas with social listening

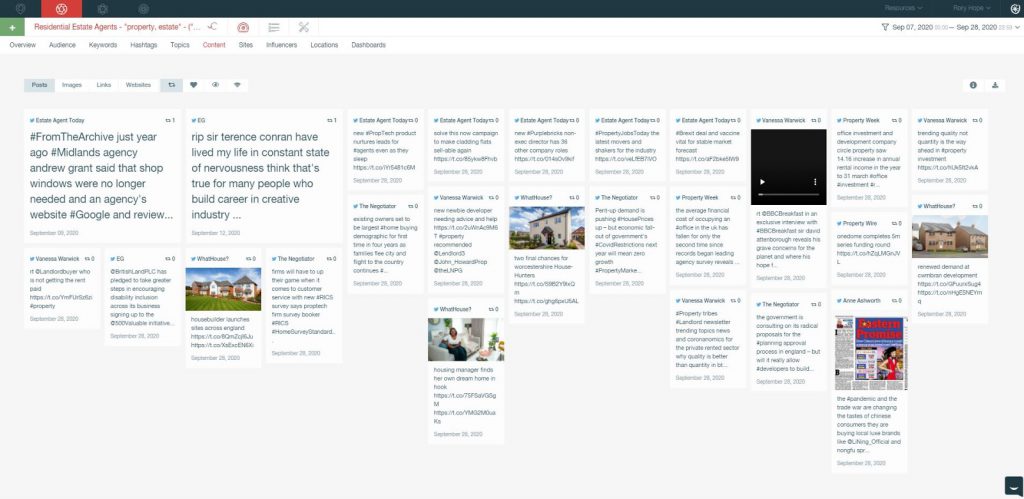

To generate a steady stream of content and digital PR campaign ideas, you should upload the top influencer entities as identified in your audience insight report for each keyword-level search audience into a social listening platform. We use Pulsar and it’s TRAC search function.

This allows you to gather Tweet data in real time from all the most influential entities based on affinity scores to the audiences that are active around your keyword topic.

This means you can plan content and digital PR campaigns with a much greater chance of success, whilst remaining hyper relevant and delivering more SEO value with every link gained.

Below are some examples of the outcome of a TRAC search for a few search audience groups in UK property.

“Residential Estate Agents” Search Audience – Pulsar TRAC:

Residential Estate Agents Search Audience – Pulsar TRAC

Residential Estate Agents Search Audience – Pulsar TRAC

“Commercial Property Agents” Search Audience – Pulsar TRAC:

Commercial Property Agents Search Audience – Pulsar TRAC

Commercial Property Agents Search Audience – Pulsar TRAC

“Housing Planning” Search Audience – Pulsar TRAC:

Housing Planning Search Audience – Pulsar TRAC

Housing Planning Search Audience – Pulsar TRAC

“Luxury Property” Search Audience – Pulsar TRAC:

Luxury Property Search Audience – Pulsar TRAC

Luxury Property Search Audience – Pulsar TRAC

Using a social listening platform to track the tweets of the influential high affinity entities to the search audiences that are active within your priority keyword segments, it empowers you to plan more relevant and engaging ideas that will directly benefit SEO performance.

Let’s look at two examples.

For the audiences that are active within the “New Homes” keyword segment, the shareable content themes are:

- Sustainability

- Politics

- Business & Leadership

- Design & Architecture

- Insurance & Risk

- Property Investment

Within the “Luxury Property” keyword segment, the most shareable content themes for the audiences are:

- Wellness

- Prestigious events

- Specialism

- Narrative & history

- Exclusivity

- Arts, culture and heritage

- Technology

- Law

5.1 How do you coordinate an audience-first SEO strategy?

To coordinate an audience-first SEO strategy, you will need to consider your tech stack and decide upon which audience intelligence technology to use. Whilst it’s also important to follow this step-by-step guide, and remember that you need to inform your audience research based on keyword intelligence to yield the greatest benefits to performance.

You can access Semetrical’s ‘Audience-first SEO Strategy Planner [Template]’shared spreadsheet to start developing your strategy.

It’s time to coin the term ‘audience-first SEO’.